Everything You Need to Know About Trampoline Financing

Get the joy and benefits of a trampoline without breaking the bank! Learn how you can finance your trampoline, plus alternatives to financing options.

min read

The joy of jumping on a trampoline has entertained kids and adults alike for decades.

The benefits of trampoline jumping can be immense, both physically and mentally, making a backyard trampoline appealing to a lot of families.

But the cost of a quality trampoline may pose a financial challenge for some families. That doesn’t mean a high-priced trampoline is out of reach though: This is where trampoline financing comes in.

As a trampoline manufacturer that offers financing on our springless trampolines, we’re going to use our expertise to inform you on when you would want to finance a trampoline, how to finance a trampoline and potential alternatives to financing.

Why Finance a Trampoline?

The main reason you would want to finance a trampoline is because you don’t want to pay the full price upfront.

This is understandable: The cost of a trampoline can run over $1,000+, which is a lot to spend on a trampoline all at once.

Other instances where you would want to finance a trampoline include managing cash flow, capitalising on special financing offers or building a credit score.

Basically, trampoline financing makes buying a high-quality trampoline more affordable: It’s just like financing a car or new furniture!

How Trampoline Financing Works

How, exactly, does financing a trampoline work?

The process could be different depending on where you want to finance a trampoline. Any number of trampoline brands, major retailers and local dealers may offer financing through financial companies that offer installment loans.

To demonstrate how trampoline financing works, let’s look at what the process looks like to finance one of our Springfree Trampolines:

Springfree Trampoline Financing

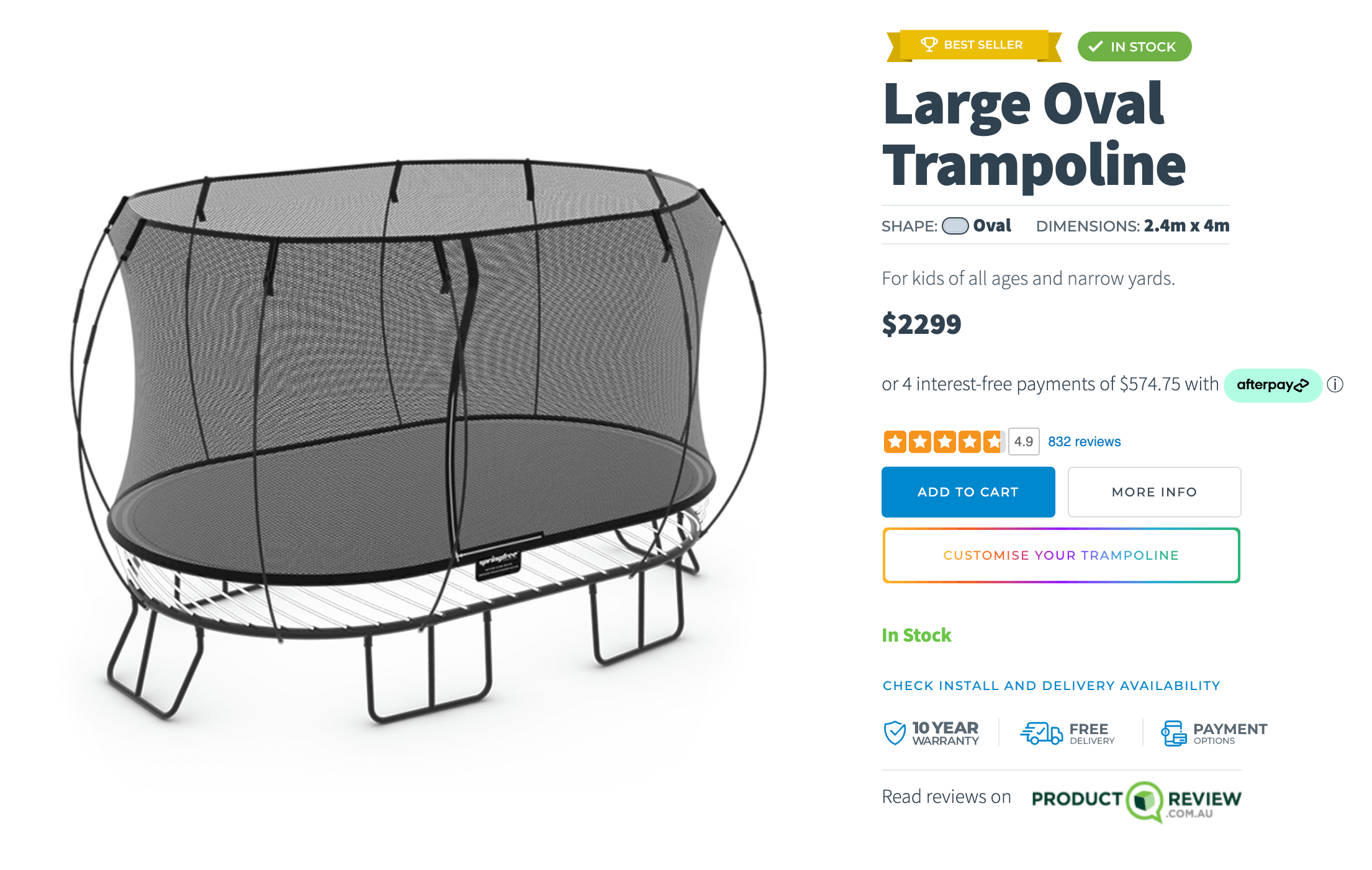

Springfree Trampoline offers financing through Afterpay, and to finance a Springfree Trampoline, you first need to shop and choose the Trampoline you want: You can do this by visiting the “Trampolines” Page on our website.

Each Springfree Trampoline will have a financing option listed in its product description. You can also choose “Paypal” at checkout to access Paypal's Pay-in-4 payment plans or "Zip", another interest-free financing option. See the image below for the Afterpay financing option (it’s under the price):

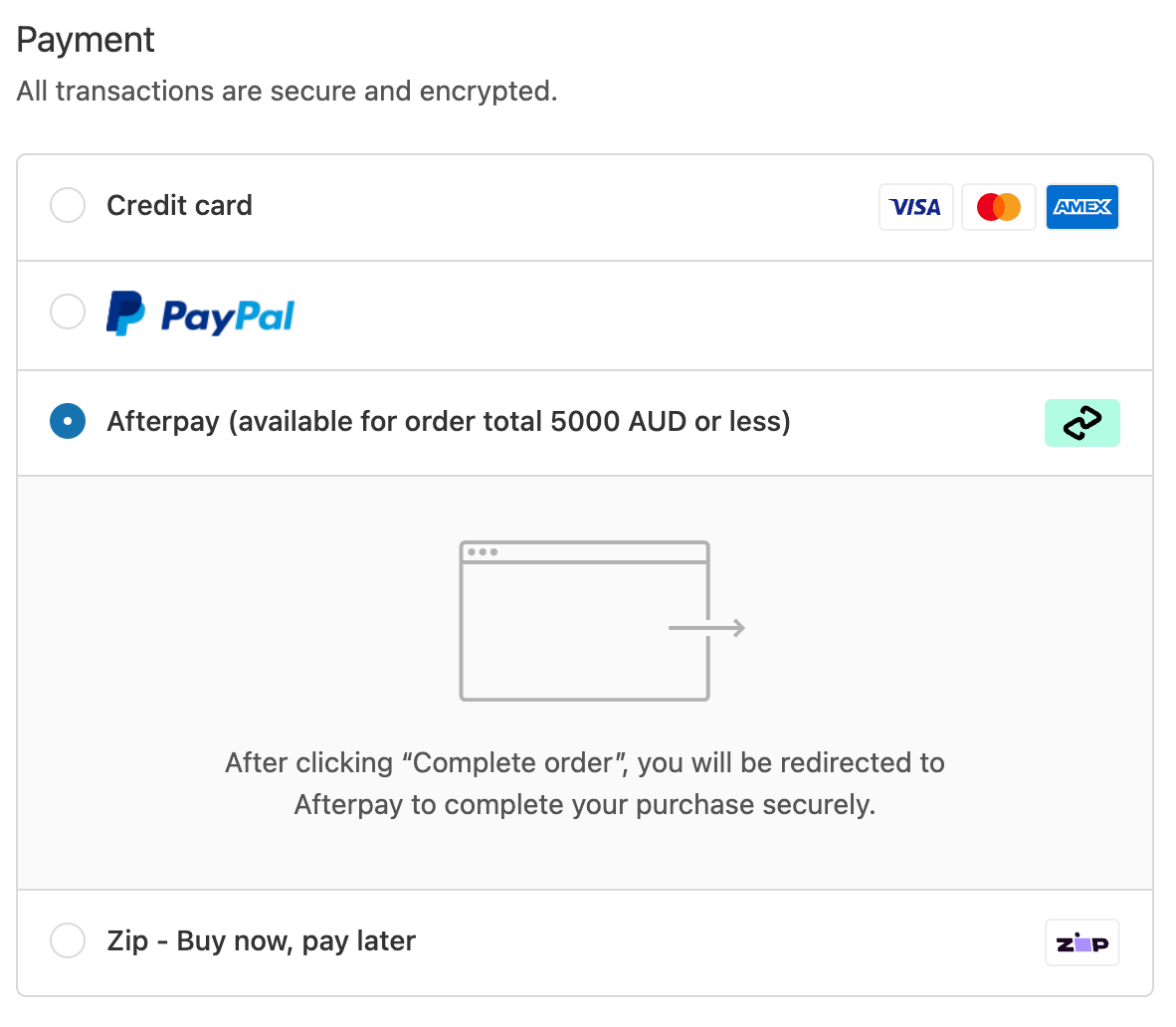

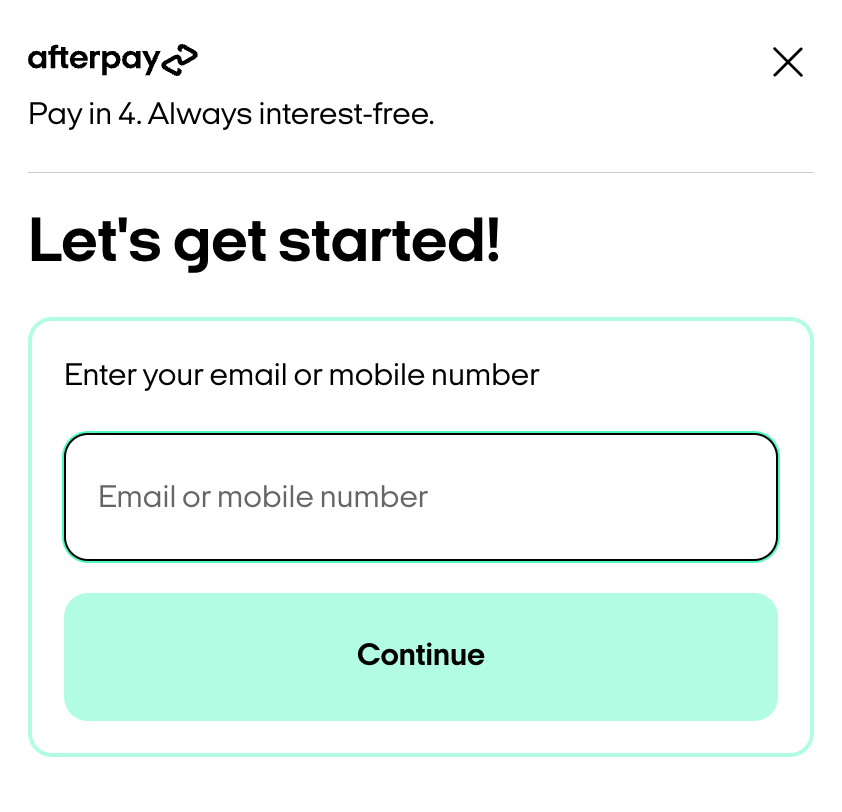

Next, you would select "Afterpay" in the checkout to be taken to a login screen that will take you through Afterpay's approval process. See the images below.

Select "Afterpay" in the checkout (above), then enter your details to go through the approval process (below).

You will then provide the required information to see if you qualify. If you do qualify (which you will find out shortly after filling out the form), you will be able to finance the Springfree Trampoline.

Financing is a popular option for our Springfree Trampolines since they are priced at a premium due to being the safest, highest quality and longest-lasting trampoline on the market. Afterpay offers 0% interest and allows you to pay for your purchase over 4 installments due every 2 weeks. You must be over 18 years old and be the authorised holder of an eligible debit/credit card to apply.

3 Alternatives to Trampoline Financing

Financing a trampoline won’t be for everybody. Interest rates, budget constraints, credit score impact and the long-term commitment of financing might be unappealing for some.

However, there are alternatives if you don’t want to finance a trampoline – let’s look at three of them in more detail:

-

Save Up to Buy a Trampoline

This is a rather obvious one, but if buying a quality trampoline is the end goal, an alternative to financing is setting aside money every month to buy your preferred trampoline in full. Some companies (like ours at Springfree) don’t accept cash, so you would have to choose another accepted form of payment.

The downside to saving up the money is you don’t get the trampoline right away. The plus side, though, is you pay it off right away and incur no debt.

-

Buy During a Promotion

You can strategically buy the trampoline you want at a discount by purchasing during a promotional period.

It’s never guaranteed that a trampoline company or retailer will be running promotions. However, if you shop during common promotional periods (Black Friday, Holiday Season), you may increase your chances of getting your desired trampoline on sale.

-

Buy a Used Trampoline

Another alternative to financing is buying a used or second-hand trampoline. The reasoning behind buying used is evident: You get the trampoline you want at a better price.

However, there are a few major shortcomings to buying a used trampoline: The product may come with tons of wear and tear, rendering it unsafe to jump on and possibly prone to breaking down sooner than later.

It’s not uncommon for people to get duped into buying a trampoline that looked good in the pictures but turned out to be on its last leg once you got a real-life view of it.

Is Financing a Trampoline Right for You?

Buying a trampoline on finance is an affordable way for many consumers to get a quality trampoline for their family.

The importance of buying a quality trampoline cannot be overstated. Cheap trampolines, while easier on the wallet, come with numerous risks, including the potentially compromised safety of your children. It’s also common for cheap trampolines to break down within 1-3 years of use.

If you’re looking for a long-term trampoline that is safe and reliable, you would be a good candidate for trampoline financing.

There are alternatives to financing, so if you don’t want to finance your trampoline, consider saving up, buying during a promotional period or vetting out used trampolines.

Springfree’s Advice: Don’t settle for a low-quality trampoline because it saves you a few bucks at purchase. Financing or various other alternatives are there to get you the trampoline that will keep your kids safe and jumping for years!

Should You Finance a Springfree Trampoline?

If you’re looking to finance a trampoline, you need to make sure the trampoline is worth the commitment.

Backed by an unbeatable FREE 10-year warranty on all parts, Springfree Trampolines are, objectively speaking, the most reliable trampoline you can buy: You can expect a Springfree Trampoline to last for 10+ years with little maintenance required assuming reasonable use.

In addition to their quality and durability, Springfree Trampolines come with the most extensive trampoline safety features, including a springless design, a net that flexes when jumped into—preventing falling injuries—a frame that cannot be hit while jumping, a mat with no hard edges and flexible enclosure rods that replace metal trampoline poles.

Check out our Springfree Trampoline Payment Options Page to learn more about your financing options and find out if buying a Springfree on finance is the right fit for your family!